Published on 6/13/2025

Announcing the launch of Internet & Organization Data—and explaining our data strategy

Our Origin: Real Unique Data

We launched Compass on May 1st, 2024. At the time, it felt like every other startup was using AI to either tell you information that you could find online, analyze information in your organization’s dataset, or both.

We’d spent our careers doing traditional customer research for large tech companies (once known as “primary research”); so, we built a massive repository of in-depth interviews and launched a product that analyzed that dataset.

That’s why GetWhys is the only platform that:

- Gives you instant access to a dataset of real, in-depth interviews with your customers; and

- Lets you request more research at no additional cost.

We were betting that this would resonate with the market. And, it did! We went from 4-digit ARR (not high) to signing our first 6-figure customer in fewer than 100 days. Our bet on real data panned out.

Today, we’re announcing an enormous expansion.

All. The. Data.

Starting today, GetWhys will be able to layer two new data sources on top of our existing dataset.

- Internet data: We’ve built an agentic, “deep research” product. The internet’s enormous and full of useless (or, worse, incorrect) data. We’ve built an agentic search experience that sifts through it for you. Signal, noise, etc.

- Organization data: Securely connect your internal customer intelligence. Sales and success transcripts, third party and win loss research, product docs, you name it.

Our customers can now layer those datasets on top of GetWhys data. We’ve spent two years building a massive dataset of real in-depth interviews with b2b software users and buyers. Our dozens of interviewers grow it every single day. We’re never giving up the advantage of real, primary research.

Importantly—these data sources are distinct and complementary. This means that:

- “What feature gaps lead to us losing deals?” builds a ranked list that combines:

- The Loss reasons your Sales team has already heard about (sources: win loss data, call recordings)

- The many, many deals you weren’t invited to that our interviewers picked up (sources: GetWhys interview data)

- Whatever Loss intelligence is scattered around the web (Sources: public reviews, internet comments, etc.)

- A product launch announcement draft incorporates:

- Feature details from your PRDs and User Journeys

- Your brand voice (pulled from your site)

- The vocabulary your target audience uses, from the many of long-form research interviews we’ve done with them

- Messaging analyses incorporate:

- The language your best customers use (from your sales calls)

- The language your target prospects use (from GetWhys)

- The near-infinite amount of commoditized AI-content (from the internet), helping you stand out.

How we think about data

Some teams have built great internet search products (e.g., Google Gemini, Perplexity). Others have built great products that leverage organizational data (e.g., Glean, Dropbox Dash). We think those internet search or organizational data vanguards are all growing towards each other (Recently, a customer told us that they were using Gemini, ChatGPT Enterprise, Qualtrics AI, Clozd AI, and GetWhys!).

The future can’t be tool sprawl.

Historically, we’ve differentiated by being the only firm with our own data, which is immensely useful to marketers, product teams, and researchers at technology companies. Interviews yield insights your target audience would never tell your team or spend hours posting online. We collect data the hard way (45-60min calls that are expensive to purchase standalone), which gets you types of information you can’t find elsewhere.

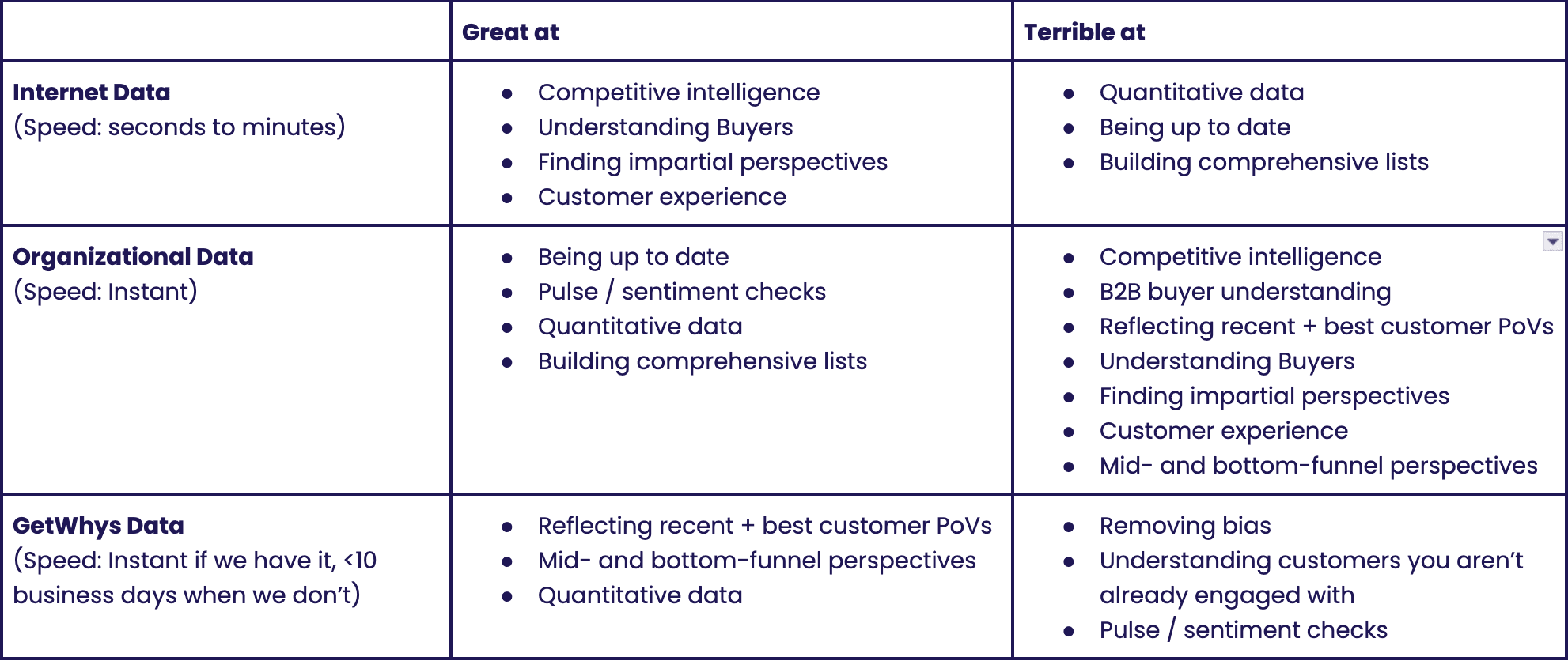

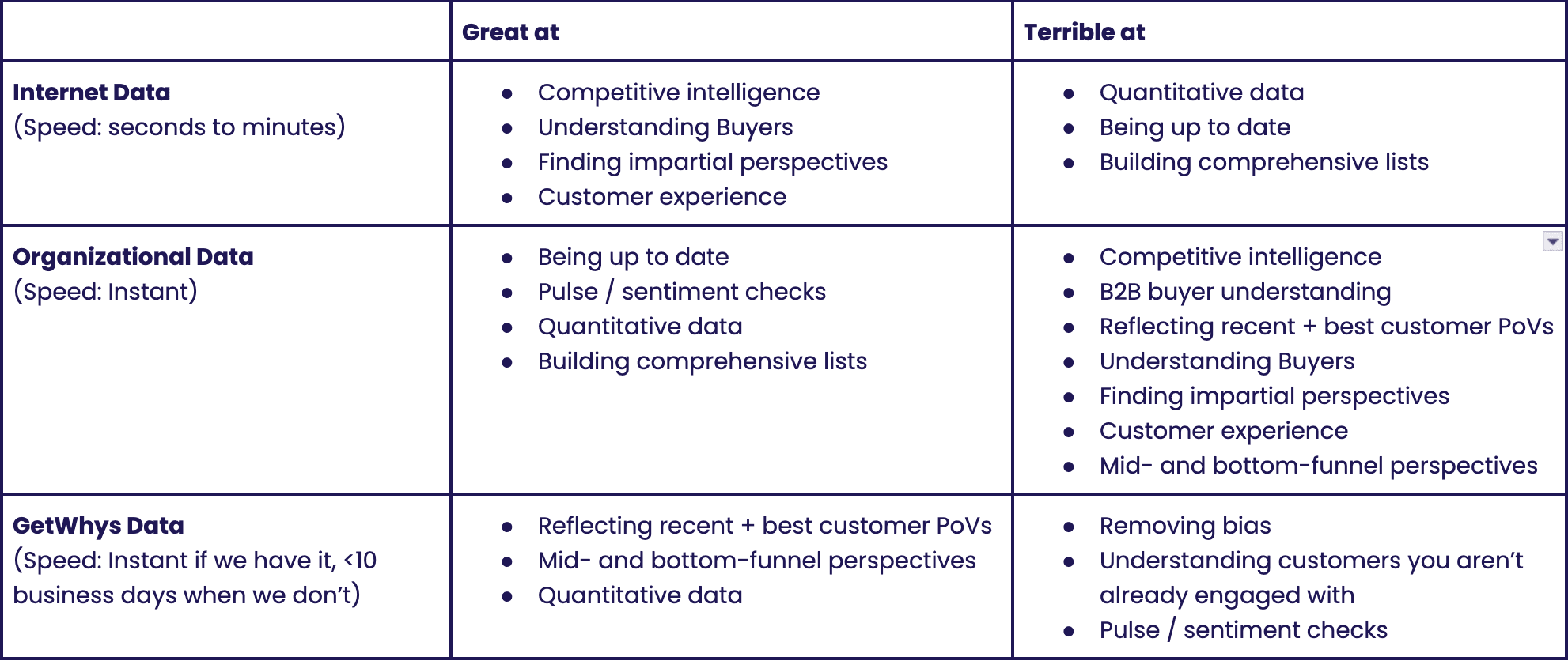

Every data source has gaps.

Layering data sources on top of each other solves many of their gaps—but, it’s not perfect. Picture 3 layers of Swiss cheese. (Yum!) Over a large enough surface area, holes will still line up.

That’s why we’re not getting rid of our primary research offering, built right in to your GetWhys subscription. If it’s information that you could only obtain by asking people… we’ll go get it for you.

Differentiation and value

When you’re competing to provide insights to your customers, it’s extremely difficult to build a moat without proprietary data.

We’re going to keep competing and winning by offering what no other product can—the data that they can access on their existing platforms coupled with unlimited access to real, primary research through our existing dataset + research requests.

We’d always rather show than tell. Grab time for a personalized demo here to see what we’ve already learned about your customers and competition.